SCANSOURCE (SCSC)·Q2 2026 Earnings Summary

ScanSource Cuts Guidance as Margins Compress, Stock Drops 5%

February 5, 2026 · by Fintool AI Agent

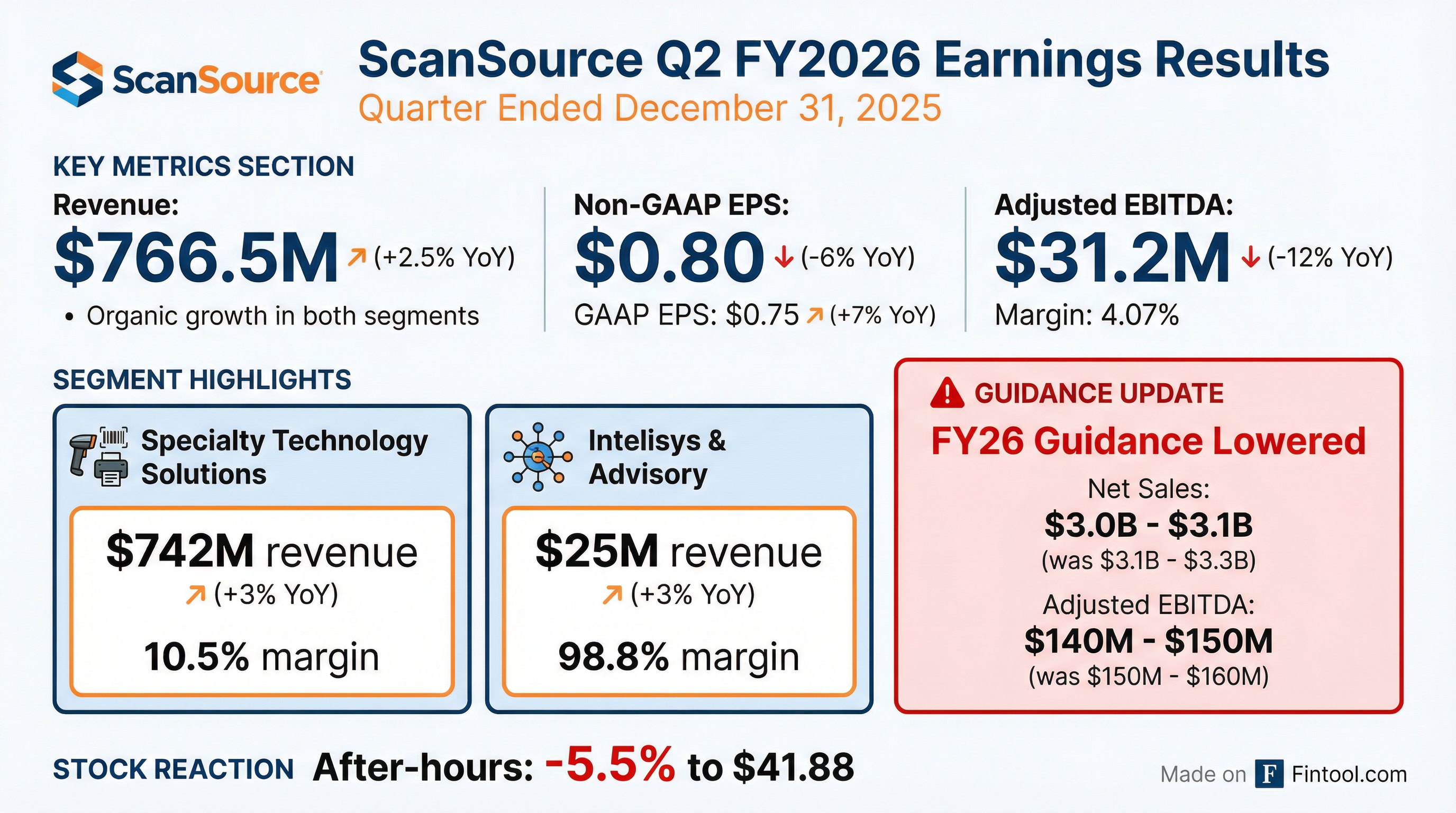

ScanSource (NASDAQ: SCSC) reported fiscal Q2 2026 results that showed topline resilience but earnings pressure, prompting management to lower full-year guidance. Revenue grew 2.5% YoY to $766.5M with organic growth in both segments, but adjusted EBITDA declined 12% to $31.2M as gross margins compressed and operating expenses increased . The stock dropped approximately 5.5% in after-hours trading following the guidance cut.

Did ScanSource Beat Earnings?

ScanSource delivered a mixed quarter with revenue growth offset by margin pressure:

The divergence between GAAP EPS (+7%) and Non-GAAP EPS (-6%) reflects the significant share repurchase activity offsetting underlying earnings pressure. Share count declined from 24.2M to 22.1M diluted shares .

How Did Each Segment Perform?

Both segments delivered organic net sales growth, though the mix tells different stories:

Specialty Technology Solutions (97% of Revenue)

- Net Sales: $741.5M (+2.5% YoY, +1.6% organic)

- Gross Margin: 10.5% (down 20bp YoY)

- Operating Income: $11.0M (-22% YoY)

- Growth driven by North America, partially offset by Brazil weakness

Intelisys & Advisory (3% of Revenue)

- Net Sales: $25.0M (+3.1% YoY)

- Gross Margin: 98.8% (down 10bp YoY)

- Operating Income: $7.5M (+17% YoY)

- Intelisys organic growth continues to outperform

Recurring revenue grew 15.9% YoY to $42.0M, now representing 37.2% of gross profit (up from 32.5%) — a positive mix shift toward higher-quality revenue .

What Did Management Guide?

ScanSource lowered FY2026 guidance, marking a notable shift from prior quarter's outlook:

Key clarification from the call: The guidance cut is driven by large deal timing, not supply shortages. CEO Mike Baur emphasized: "Our guidance is relative to large deals, not to shortages. We're not indicating that there's gonna be a shortage impact on our guidance."

The guidance implies H2 looks similar to H1 with modest growth, historically a 49/51 to 50/50 H1/H2 split. Management has strong confidence in at least $80M free cash flow based on their business model transformation .

How Did the Stock React?

SCSC shares closed the regular session at $44.33, up 0.9% ahead of the earnings release. However, after-hours trading showed a sharply negative reaction:

- After-Hours Price: $41.88

- After-Hours Move: -5.5% from close

- 52-Week Range: $28.75 - $46.25

The stock had rallied approximately 54% from its 52-week low, leaving it vulnerable to any disappointment. The guidance cut appears to have caught investors off guard.

What Changed From Last Quarter?

Several key shifts emerged relative to Q1 FY26:

The sequential deterioration in profitability is concerning. Gross margin dropped 110bp QoQ while SG&A expenses increased, creating a margin squeeze. Operating leverage is working against the company despite revenue growth.

Balance Sheet and Cash Flow Highlights

Despite earnings pressure, cash generation remains solid:

The company secured a new 5-year credit facility to support its growth strategy .

3-Year Strategic Goals Update

Management reaffirmed commitment to mid-term targets despite near-term headwinds:

The gap between current performance and strategic targets appears to be widening rather than narrowing this quarter.

Governance Changes

The Board announced leadership transitions effective January 29, 2026:

- Charles A. Mathis appointed Lead Independent Director and Chair of Nominating/Governance Committee, succeeding Peter C. Browning

- Vernon J. Nagel appointed Chair of Audit Committee, succeeding Mathis

- Peter Browning remains on the Board as an independent director

What's the New Strategic Initiative?

ScanSource announced a major go-to-market change: a new converged communications sales team unifying hardware and cloud/CX solutions:

Problem being solved: Previously, if a Mitel/Avaya hardware partner wanted connectivity products or cloud services, the Specialty seller had to pass that lead to Intelisys — friction that lost deals .

New model: One unified team can sell both Specialty hardware products AND Intelisys cloud/CX solutions to the same partner. Intelisys employees will now also sell hardware .

Management view: "We believe end users are embracing cloud-based UCaaS and CX platforms, and this is a growth opportunity for our channel partners." — Mike Baur

Financial reporting: No change to segment reporting — this is a management alignment and go-to-market change, not a segment restructuring .

What About Intelisys New Orders vs. Billings?

Management emphasized a critical leading indicator: new orders are growing faster than billings .

Key dynamics:

- Conversion lag: New orders take 6-12 months (up to 15 months) to convert into billings

- Investment thesis: ScanSource brought on Ken Mills over 1.5 years ago to drive more aggressive new customer acquisition

- Partner aging peaked: ~1.5 years ago many partners were selling their books of business; that trend has diminished

- ROI confidence: Continued investment in Intelisys signals management believes there's a good ROI on new order growth initiatives

"If we're still investing in Intelisys and in that order growth, we believe that there's a good ROI on that, because this all has to hold together with our three-year goals." — CFO Steve Jones

Q&A Highlights

On Large Deal Timing (Greg Burns, Sidoti): Large deals are being broken up into smaller pieces and rolling out more slowly — this is a timing issue, not a loss of demand. Management surveyed partners at last week's sales kickoff; shorter-term visibility suggests deals will resume in H2 .

On Period Expenses (CFO Steve Jones): The Q2 margin compression was driven by: (1) freight costs and mix in COGS (~30bp gross margin impact), (2) a customer-specific bad debt reserve. Management considers these period-related, not structural .

On Memory Supply Issues (Keith Housum, Northcoast): Suppliers are flagging that memory issues may affect pricing and potentially supply, but visibility is limited. The guidance cut does NOT include significant shortage impact — it's primarily about large deal timing .

On Brazil Weakness: Brazil was down 9% organic YoY — a market-wide condition affecting all distributors. Brazil carries higher-than-average gross margin that flows through to the bottom line, making the weakness particularly painful .

On TSD Competitive Environment (Guy Hardwick, Barclays): PE-backed competitors have slowed headcount additions (flat or down for 6 months). ScanSource believes acquisition-driven growth has slowed, shifting focus to organic growth where they can gain share .

On Capital Allocation (Adam Tindle, Raymond James): With stock trading below book value post-earnings, management reiterated commitment to buybacks. $179M remaining authorization; $40M deployed in H1 FY26. Three-year strategic goals remain intact despite near-term headwinds .

Key Takeaways

-

Revenue resilient, margins under pressure from period costs: Organic growth in both segments was overshadowed by freight/mix costs and a bad debt reserve — management says period-related, not structural .

-

Guidance cut driven by large deal timing, not demand loss: Deals are being broken into smaller pieces and pushed out. Management has partner survey data supporting H2 recovery .

-

New converged communications team is a strategic bet on UCaaS/CX: Unifying hardware and cloud sales to same partners — removes internal friction and positions ScanSource for recurring revenue growth .

-

Intelisys new orders outpacing billings: Key leading indicator for future revenue, though 6-15 month conversion lag delays financial impact .

-

Brazil drag material: Down 9% organic with high flow-through margins — a headwind until market conditions improve .

-

Memory supply is a watchlist item: Suppliers flagging potential pricing/shortage issues, though not currently in guidance .

-

Capital allocation remains aggressive: Trading below book value post-earnings with $179M buyback authorization and strong FCF generation supports continued repurchases .

This analysis incorporates ScanSource's Q2 FY2026 earnings conference call held February 5, 2026 at 10:30 AM ET.

Related Links: